The Facts About Hsmb Advisory Llc Uncovered

The Facts About Hsmb Advisory Llc Uncovered

Blog Article

Rumored Buzz on Hsmb Advisory Llc

Table of ContentsFacts About Hsmb Advisory Llc RevealedSome Of Hsmb Advisory LlcNot known Details About Hsmb Advisory Llc The 45-Second Trick For Hsmb Advisory LlcThe Ultimate Guide To Hsmb Advisory Llc7 Easy Facts About Hsmb Advisory Llc Shown

If the plan owner is under 59, any kind of taxable withdrawal may likewise undergo a 10% federal tax obligation charge. Riders may incur an additional expense or premium. Motorcyclists may not be available in all states. All whole life insurance policy warranties go through the prompt repayment of all called for costs and the insurance claims paying capacity of the providing insurance coverage firm.

The money abandonment worth, funding worth and fatality earnings payable will certainly be minimized by any lien impressive due to the repayment of an accelerated advantage under this motorcyclist. The sped up advantages in the initial year mirror reduction of an one-time $250 administrative charge, indexed at a rising cost of living price of 3% each year to the price of velocity.

Our Hsmb Advisory Llc PDFs

A Waiver of Premium rider forgoes the commitment for the policyholder to pay further costs should he or she become entirely handicapped constantly for a minimum of 6 months. This motorcyclist will sustain an extra expense. See policy agreement for additional information and demands.

Below are a number of cons of life insurance: One disadvantage of life insurance coverage is that the older you are, the extra you'll spend for a policy. This is because you're most likely to die during the plan period than a more youthful insurance holder and will, subsequently, set you back the life insurance policy firm even more cash.

While this may be a plus, there's no warranty of high returns. 2 If you pick an irreversible life policy, such as whole life insurance policy or variable life insurance coverage, you'll receive lifelong insurance coverage. The caveat, nonetheless, is that your costs will certainly be greater. 2 If you're interested in life insurance policy, consider these suggestions:3 Don't wait to make an application for a life insurance coverage policy.

An Unbiased View of Hsmb Advisory Llc

By applying for life insurance policy protection, you'll be able to aid secure your liked ones and get some peace of mind. If you're unclear of what kind of protection you ought to obtain, speak to an agent to discuss your alternatives.

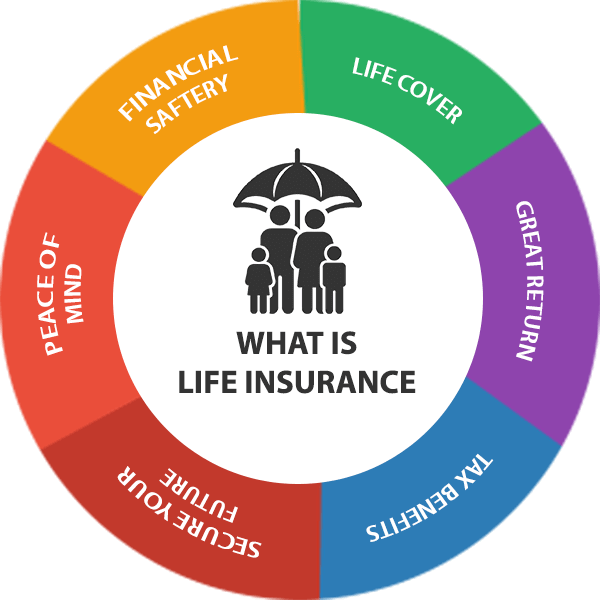

There are lots of prospective benefits of life insurance policy however it's normally the confidence it can provide that matters the most - https://pagespeed.web.dev/analysis/https-www-hsmbadvisory-com/gkfdu4b91b?form_factor=mobile. This is since a payment from life cover can work as an economic safeguard for your loved ones to fall back on ought to you die while your plan remains in area

But the overriding benefit to all is that it can take away at the very least one concern from those you care around at a tough time. Life insurance can be established to cover a home mortgage, potentially helping your family members to remain in their home if you were to die. A payout might help your dependants replace any earnings shortage really felt by the loss of your revenues.

Hsmb Advisory Llc Can Be Fun For Everyone

A payment could be used to help cover the price of your funeral. Life cover can aid minimize if you have little in the way of cost savings. Life insurance policy products can be utilized as part of estate tax preparation in order to decrease or avoid this tax obligation. Putting a policy in count on can give greater control over properties and faster payouts.

You're ideally removing some of the tension felt by those you leave. You have tranquility of mind that liked ones have a certain degree of economic security to draw on. Getting life insurance policy to cover your home loan can provide satisfaction your mortgage will be settled, and your liked ones can proceed living where they have actually constantly lived, if you were to die.

See This Report on Hsmb Advisory Llc

Arrearages are normally paid off using the value of an estate, so if a life insurance policy payment can cover what you owe, there click now ought to be more delegated pass on as an inheritance. According to Sunlife, the typical expense of a standard funeral service in the UK in 2021 was just over 4,000.

Facts About Hsmb Advisory Llc Revealed

It's a significant sum of cash, but one which you can give your loved ones the chance to cover utilizing a life insurance policy payout. You ought to consult your company on details of just how and when payments are made to guarantee the funds can be accessed in time to spend for a funeral service.

It might likewise offer you extra control over that obtains the payout, and assist lower the possibility that the funds might be made use of to pay off financial debts, as could happen if the plan was beyond a count on. Some life insurance coverage plans consist of a terminal illness advantage choice at no extra expense, which might cause your policy paying early if you're detected as terminally unwell.

An early settlement can enable you the possibility to get your events in order and to maximize the time you have left. Losing somebody you love is hard sufficient to take care of by itself. If you can help relieve any type of concerns that those you leave might have regarding exactly how they'll cope economically moving on, they can concentrate on the important things that truly ought to matter at one of the most hard of times.

Report this page